Can Cannabis Weather the Storm? Is the Industry Recession-Proof?

Explore the future of the cannabis industry as it faces potential economic challenges.

Is the cannabis industry truly recession-proof? Dive deep into our exploration, assessing the industry’s distinct hurdles, extraordinary narrative, and capacity for endurance as it navigates into unknown economic territory. Taking lessons from the tech industry’s past, we contemplate whether it can endure a financial crisis and emerge even more resilient.

The cannabis industry—born into a confluence of cultural shifts, legislative action, and business innovation—has never seen a recession. Not yet, anyway. But with the whispers of an economic downturn growing louder, the cannabis industry is approaching uncharted waters.

With a litany of inherent challenges—the oversupply of cannabis flower in various markets, the ever-looming specter of federal prohibition, and continuous banking hurdles—the cannabis industry appears shaky on the surface. But cannabis isn’t your ordinary business sector. It has a distinct story, interwoven with adaptability, innovation, and unyielding tenacity. As such, when we question the impact of a potential recession, the industry’s vulnerability isn’t really the issue at hand.

The real question is whether the cannabis industry has cultivated enough resilience to not only weather the incoming storm, but flourish amidst the turbulence.

Is The Cannabis Industry Recession-Proof?

The complexities of the cannabis industry unfold when one delves deeper into its diverse sectors. As the winds of economic turmoil start blowing, it’s crucial to understand how different facets of the industry might respond to the chill.

According to a report by MJ Biz Daily, the cannabis industry as a whole might be in for a rude awakening in a post-pandemic recession. Industry executives have expressed concerns about inflation curbing consumer purchases, along with stalled federal marijuana reform efforts stifling the momentum of the cannabis movement.

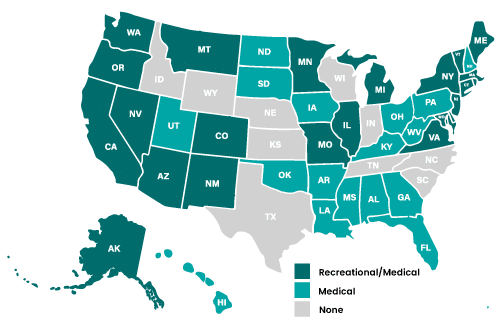

On the state level, select markets might be shielded from these economic headwinds. New markets such as Florida, Illinois, Massachusetts, New Jersey, and New York—where licenses are limited and wholesale cannabis prices are comparatively high—may have a less competitive landscape and could fare better during economic upheaval. On the other hand, established markets like Colorado, Oregon, and Washington state could face more significant challenges due to overproduction, falling wholesale prices, and intensifying competition.

Cannabis Legalization Map – 2023

Indeed, the very nature of the cannabis industry makes the question of recession resistance a tough nut to crack. The potential impact of a recession on the cannabis industry could vary significantly depending on regional market dynamics, making it a complex scenario to predict.

How can dispensaries, cannabis flower producers, ancillary businesses, stockholders, and capital investors adapt and thrive? Let’s explore these sectors and discern their potential resilience in the face of a recession.

Dispensaries

In the world of cannabis dispensaries, competition is relentless, and in states where licenses were issued without restraint, the marketplace risks saturation. As consumer spending tightens and market dynamics evolve, a financial slump could see the survival of only the fittest and most resourceful.

Cannabis Flower

With an oversupply in many states, the cannabis flower segment faces a precarious situation. A recession could further suppress prices and inflate inventory, so innovative strategies may become the lifeline for businesses dealing with this surplus.

Cannabis Stocks

The cannabis stock market, often compared to a rollercoaster ride, could grow increasingly volatile during a recession. A market slowdown may cause investors to exhibit more apprehension, adding another challenge for cannabis businesses that rely on a healthy stock performance.

Capital Investment

Given the cannabis industry’s complex relationship with traditional banking, the scarcity of capital investment during a recession could present a significant hurdle. This financial crunch might serve as a catalyst for the emergence of innovative, resilient financing models, potentially reshaping the industry’s financial landscape.

Ancillary Businesses

Cannabis ancillary businesses, which include software developers, testing laboratories, logistics and transportation concerns, and equipment and supply manufacturers, are the unsung heroes of the industry. They provide indispensable services that keep the wheels of the cannabis machine turning, and their sustainability during tough economic times is crucial not just for their survival, but for the health of the entire industry.

The Impact of Inflation on the Cannabis Industry and Its Consumers

The specter of inflation is always lurking in the shadows of any strong economy, waiting to negatively impact businesses and consumers at the first sign of weakness. For the cannabis industry and its consumers, inflation can tighten the screws on the already complex economic machinery.

At its worst, inflation relentlessly drains the value of money. Rising prices and faulting purchasing power impact both the cost of living and the cost of doing business. It’s something we all experienced during the COVID pandemic’s postscript—businesses increased prices to maintain profit margins, forcing consumers to shell out more money for the same products and services.

In the context of the cannabis industry, inflation can have several effects:

- Increased operational costs: Everything from the cost of cultivation—such as equipment, nutrients, and utilities—to processing and distribution can rise. Dispensaries may also see increased costs for leasing retail space, utilities, and employee wages.

- Price increases for consumers: To compensate for increased operational costs, cannabis businesses may increase the prices of their products. Consumers would then bear the brunt of these price hikes, which could affect their purchasing habits.

- Shifts in consumer behavior: Inflation pushes consumers to change their behavior. They may choose lower-priced products, purchase less frequently, or even switch to different consumption methods if they are more cost-effective.

- Potential impact on medical cannabis patients: Inflation could particularly affect medical cannabis patients who rely on cannabis for treatment. Increased prices could lead to financial strain, potentially forcing them to compromise on their medical needs.

- Effect on profit margins: If costs rise and competitive pressures or consumer sensitivity prevent businesses from increasing prices, profit margins could fall.

- Potential barrier to entry: Inflation can also increase the cost of starting a new cannabis business, serving as a potential barrier for new entrants into the industry.

Inflation can present dire circumstances for an endless array of industries, but it can also lead to innovation and efficiency as businesses strive to manage increased costs and consumers seek the best value for their money.

The Cannabis Industry's Future

The future of the cannabis industry may be better understood by looking back at the historical trends of a different sector entirely: technology. As pointed out in a recent Forbes article, the early days of the tech industry saw a similar boom-and-bust cycle to what we’re witnessing in the cannabis industry now.

During the “dot-com bubble” of the late 1990s, many technology companies saw meteoric rises in value. However, this rapid growth often outpaced the development of solid business foundations, resulting in an industry-wide crash and subsequent contraction. But society’s return to the dark ages—or at least, the analog days—never happened. Instead, the tech industry evolved. Following the crash, tech companies consolidated, and there was a greater emphasis on sound business practices. Over time, new major players like Google and Amazon emerged.

The cannabis industry might follow a similar trajectory. While the industry is currently facing a sharp decline with many companies struggling to survive, this could be a necessary correction. Like the tech industry before it, the cannabis industry may see a period of consolidation and refocusing on business fundamentals.

Despite the present challenges, there are several factors that signal a bright future for the cannabis industry. One of these is the development of new markets globally, while another is the increasing momentum towards federal legalization in the United States.

Emerging Markets

The “Google” of the legal cannabis industry has yet to reveal itself. As such, there’s much room to grow in the worldwide marketplace. As regulatory changes begin to circumnavigate the globe, new business opportunities will arise. These emerging markets hold the potential for substantial growth, driven by increasing acceptance of cannabis products for medical and recreational use, rising investment in research and development, and the decriminalization and legalization of cannabis in several countries.

Federal Legalization

The prospect of federal legalization in the United States is one of the most significant potential catalysts for growth in the cannabis industry. Federal legalization would dramatically expand the domestic market and influence the global stance on cannabis regulation and trade. It would also eliminate many of the existing barriers to business growth, such as access to banking services and interstate trade restrictions. While the timeline for federal legalization remains unclear, the shift in public sentiment and growing bipartisan support suggest that this change could be on the horizon.

Banking

(Secure and Fair Enforcement (SAFE) Banking)

Under the umbrella of federal legalization, there’s a particular issue that warrants specific attention: the need for secure and fair banking services for cannabis businesses. The current legislation, known as the Secure and Fair Enforcement (SAFE) Banking Act, aims to rectify the financial challenges cannabis companies face.

Historically, due to the federal illegality of cannabis, financial institutions have been reluctant to provide services to businesses operating in this sector. This has forced many cannabis businesses to operate on a cash basis, which presents security risks and operational challenges.

The SAFE Banking Act would provide protections for banks that serve state-legal cannabis businesses, thereby opening essential banking services to these companies. The passage of this act would be a game-changer for the industry, significantly easing operations and paving the way for increased investment in the sector.

The Resilience and Future of the Cannabis Industry

The cannabis industry stands at the intersection of potential and challenge—marked by an extraordinary resilience and fueled by the ceaseless innovation and tenacity that defines its narrative. The current financial uncertainties may test this resilience, but it is through such tests that strength and adaptability are truly proven.

Regional nuances and sector-specific dynamics further complicate the picture, making it a challenge to predict exactly how the industry will navigate the future. Yet, with emerging markets, the prospect of federal legalization, and the potential for banking reform, the industry’s future appears to hold vast potential.

Despite the numerous challenges—from the oversupply of cannabis flower to the shadow of federal prohibition—the cannabis industry’s future is still being written. Whether it can weather the storm and prove recession-proof remains to be seen, but its intrinsic resilience offers hope.

Connect with Hybrid Marketing Co., your guide in this dynamic, growing market. Our team of experts is ready to help you understand and leverage the market trends for your success.

-

Jen Lamboy

Jen Lamboy

- Jen is Hybrid Marketing Co's VP of Strategy. She entered cannabis through seed genetics and has passionately worked to help grow the industry into a global game-changer ever since. As a strategist focused on business outcomes, Jen has worked in numerous highly-regulated industries with B2B and B2C organizations. She doesn't step lightly; she charges but with a collaborative spirit, intention, intelligence, humility, compassion, and grit.